Постинг

27.05.2010 00:43 -

Златото ли е следващият балон?

Интересна статия от the Wall Street Journal

Gold vs Nasdaq and Housing But if gold is a bubble, here"s why it may not be over—and, indeed, may it may be about to go vertical.

First, the recent rise is deceptive. Yes, gold has risen from around $250 an ounce to $1,200. But that rise started at very depressed levels. Gold had been falling in price for two decades. In 2000-01, it was at the bottom of a very deep bear market. It had touched historic lows compared to consumer prices or other assets like shares. A lot of the past decade"s boom has simply seen it recover toward longer-term averages.

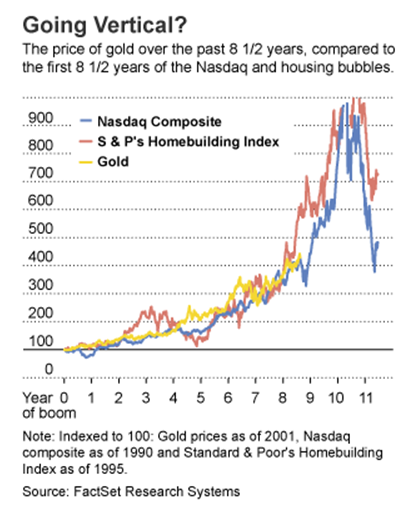

Second, before we assume the gold bubble has hit its peak, let"s see how it compares with the last two bubbles—the tech mania of the 1990s and the housing bubble that peaked in 2005-06. The chart is below, and it"s both an eye-opener and a spine-tingler.

It compares the rise in gold today with the rise of the Nasdaq in the 1990s and the Dow Jones index of home-building stocks in the 10 years leading up to 2005-06.

They look uncannily similar to me.

So far gold has followed the same path as the previous two bubbles. And if it continues along the same trajectory—a big if—gold today is only where the Nasdaq was in 1998 and housing in 2003.

In other words, just before those markets went into orbit.

Maybe the smart money is out of gold today. But how easily we forget that the smart money got out of these past bubbles way too early. The really smart money knows you make the most money in a bubble right at the end, when it goes manic.

Gold vs municipal bonds

There are other reasons to think that gold is still a long way from that point.

Like the futures market. It is predicting gold will rise by just a few percent a year over the next few years. That"s less than you"d get from municipal bonds.

When the market thinks an investment is going to underperform munis, it"s safe to say we are not in the midst of euphoria.

And take a look at the coverage of this industry. At the peak of a bubble, the Wall Street analysts covering a sector are usually all bullish. This time around? Far from it. Of the analysts covering gold-mining giant Barrick Gold, only about two-thirds are publicly bullish, according to Thomson Reuters. By Wall Street standards, that"s very restrained. Among those covering Newmont Mining and Randgold Resources, it"s about half.

Ето тук може да се прочете цялата статия:Is Gold the Next Bubble?

Gold vs Nasdaq and Housing But if gold is a bubble, here"s why it may not be over—and, indeed, may it may be about to go vertical.

First, the recent rise is deceptive. Yes, gold has risen from around $250 an ounce to $1,200. But that rise started at very depressed levels. Gold had been falling in price for two decades. In 2000-01, it was at the bottom of a very deep bear market. It had touched historic lows compared to consumer prices or other assets like shares. A lot of the past decade"s boom has simply seen it recover toward longer-term averages.

Second, before we assume the gold bubble has hit its peak, let"s see how it compares with the last two bubbles—the tech mania of the 1990s and the housing bubble that peaked in 2005-06. The chart is below, and it"s both an eye-opener and a spine-tingler.

It compares the rise in gold today with the rise of the Nasdaq in the 1990s and the Dow Jones index of home-building stocks in the 10 years leading up to 2005-06.

They look uncannily similar to me.

So far gold has followed the same path as the previous two bubbles. And if it continues along the same trajectory—a big if—gold today is only where the Nasdaq was in 1998 and housing in 2003.

In other words, just before those markets went into orbit.

Maybe the smart money is out of gold today. But how easily we forget that the smart money got out of these past bubbles way too early. The really smart money knows you make the most money in a bubble right at the end, when it goes manic.

Gold vs municipal bonds

There are other reasons to think that gold is still a long way from that point.

Like the futures market. It is predicting gold will rise by just a few percent a year over the next few years. That"s less than you"d get from municipal bonds.

When the market thinks an investment is going to underperform munis, it"s safe to say we are not in the midst of euphoria.

And take a look at the coverage of this industry. At the peak of a bubble, the Wall Street analysts covering a sector are usually all bullish. This time around? Far from it. Of the analysts covering gold-mining giant Barrick Gold, only about two-thirds are publicly bullish, according to Thomson Reuters. By Wall Street standards, that"s very restrained. Among those covering Newmont Mining and Randgold Resources, it"s about half.

Ето тук може да се прочете цялата статия:Is Gold the Next Bubble?

Балон ли е златото?

Най-добрите цени за отпадъци от черни и ...

Къде се изкупуват на най - добри цени вт...

Най-добрите цени за отпадъци от черни и ...

Къде се изкупуват на най - добри цени вт...

Търсене

За този блог

Гласове: 9412

Блогрол

1. The New York Times

2. bloomberg

3. reuters

4. wsj

5. cnn

6. ft

7. bbc

8. Washingtonpost

9. световни статистически данни в сегашно време

10. online graphical dictionary

11. Ideas Worth Spreading

12. charlierose

13. flightaware

14. flightview

15. Worldclock

16. Online converter

17. flurrious

18. THEOI GREEK MYTHOLOGY

19. brainz

20. stumbleupon

21. mapper.nndb

22. gladwell

23. interactive map of New York city

24. google finance

25. Public Data Explorer

26. Los Angeles Times

27. propublica

28. chicagotribune

29. indexmundi

30. c-span

2. bloomberg

3. reuters

4. wsj

5. cnn

6. ft

7. bbc

8. Washingtonpost

9. световни статистически данни в сегашно време

10. online graphical dictionary

11. Ideas Worth Spreading

12. charlierose

13. flightaware

14. flightview

15. Worldclock

16. Online converter

17. flurrious

18. THEOI GREEK MYTHOLOGY

19. brainz

20. stumbleupon

21. mapper.nndb

22. gladwell

23. interactive map of New York city

24. google finance

25. Public Data Explorer

26. Los Angeles Times

27. propublica

28. chicagotribune

29. indexmundi

30. c-span